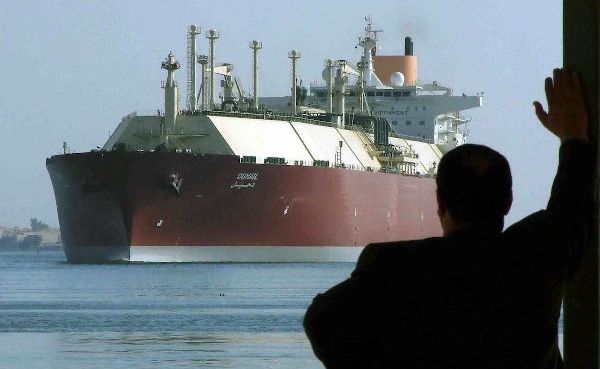

The liquefied natural gas (LNG) market is approaching potentially historic shortfall this winter as major importers rush to stockpile the fuel, Bloomberg reported today, May 24.

Europe’s plan to cut imports of pipeline Russian gas by two-thirds by the end of the year and replace it with LNG from the U.S. and Africa is sharply increasing competition for fuel for power plants and national heating systems. China’s fight against another wave of the Covid-19 coronavirus infection is expected to end later in 2022, which should stimulate industrial demand from Asia’s largest economy.

In a typical year, LNG importers stockpile in summer for peak energy consumption during the winter season. However, it appears that this year, given the extremely tense geopolitical situation due to the conflict in Ukraine, the restocking began in early spring, when, in particular, South Korean and Japanese utilities contracted LNG supplies until early 2023.

The looming supply crisis risks significantly increasing energy bills and further raising inflation. This risks leaving poorer countries in a state of “total losers,” the agency notes.

“The coming winter will put everyone on alert,” predicted James Whistler, head of energy resources at Simpson Spence Young. – Everything points to (future) supply disruptions, there are additional risks.

How to cope with the widening gap between supply and demand will be the main topic at this week’s World Gas Conference in South Korea. This is the first major industry gathering in Asia since the Ukraine crisis turned the LNG trade upside down and caused fuel prices to soar.

Global demand will reach 436 million tons in 2022, surpassing 410 million tons of available supply, according to this month’s report by Norwegian analyst firm Rystad Energy. Although the rapid growth in consumption has triggered the biggest rush for new projects worldwide in more than a decade, most of the new supply will not appear until after 2024, it said.

Traders are diverting LNG supplies from Asia and prefer to sell to Europe, where prices are more attractive. Germany is speeding up construction of floating import terminals, the first of which is due to launch this year. LNG trade is likely to shift even more to a narrow spot market in the coming months, probably at the expense of developing countries such as India and Pakistan.

“There is no excess capacity in the global gas complex, leaving Europe and Asia in a tug-of-war over available reserves,” states Michael Stoppard, head of global gas strategy and special advisor at S&P Global Commodity Insights.

European gas prices have fallen from their peak in early March but are still well above average for this time of year. The decline could give buyers in the region more room to restock over the next few months, but much will depend on how quickly Chinese demand recovers as the world’s largest LNG importer looks to spot fuel supplies. Nevertheless, many Chinese companies are reluctant to make deals because consumption will remain low, which could lead to a surge in purchases at the end of the year.

“Strong LNG demand in Europe is inevitable, but the clue is China, where current demand remains weak given the ongoing Covid-19 lock-ups and slowing economic growth,” Valerie Chou, head of gas research in Asia Pacific at Wood Mackenzie, told Bloomberg. – The market will be tight ahead of winter as buyers from Europe and Asia compete for volumes.

As reported by EADaily, Germany plans to work with Senegal to develop an offshore gas field amid the most serious impact of the conflict in Ukraine on global energy supplies and prices. This became known last Sunday when German Chancellor Olaf Scholz began his tour of several African countries, including Senegal, Niger and South Africa.

490 total views, 2 views today